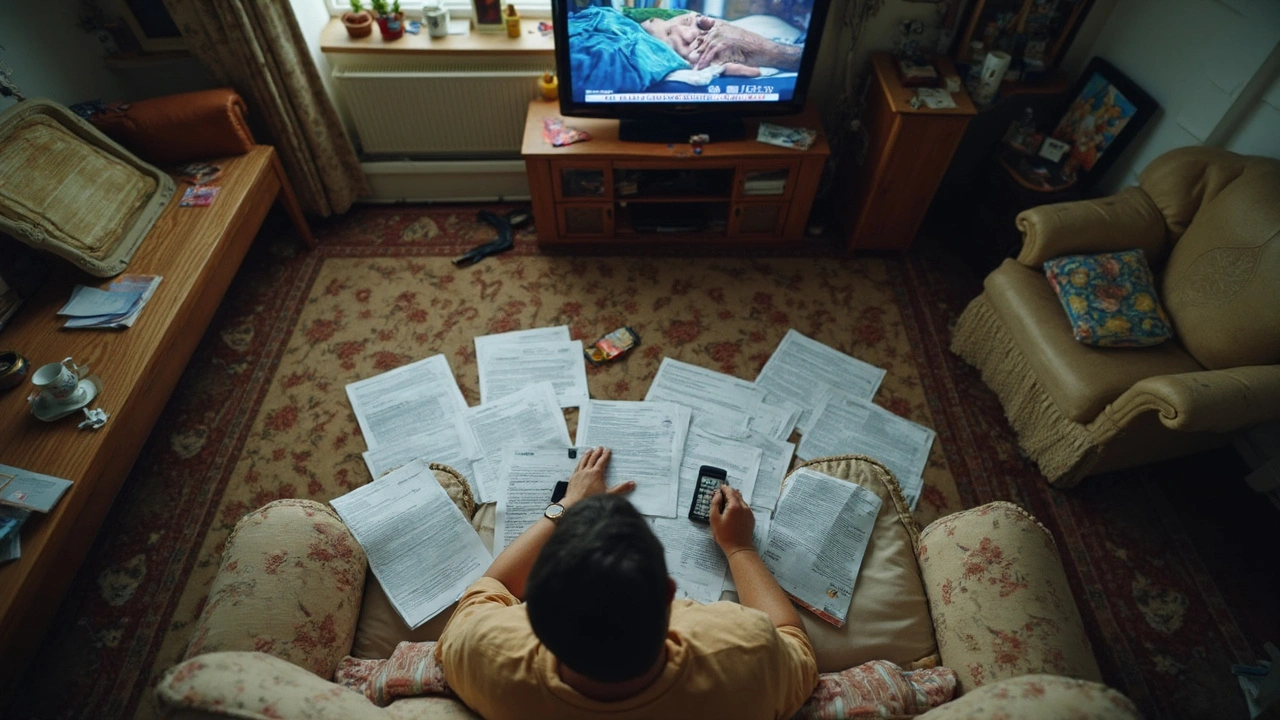

Forget fancy explanations—everyone feels it: the cost of living in the UK has shot through the roof. You go to the shop, grab the same basket as last year, and the bill somehow doubles. Try finding a flat in London or Manchester without handing over half your paycheck. Even heating your home feels like a luxury game.

The headlines talk about inflation, but what does that mean for real people? It's more than just numbers. Rent, food, transport—all the basics—take bigger bites every month. And wages? They barely get a nibble ahead. If you've ever wondered why your money runs out sooner or why people are skipping meals or taking extra shifts just to keep the lights on, you're not alone.

The squeeze isn't just about stats or gloomy news. It's about your weekly shop, your commute, your next energy bill. This article dives into what's fuelling the mess, gives you some facts that might just make sense of it all, and shares real tips so you aren't just left hoping for better days ahead.

- How Did Things Get This Bad?

- Everyday Costs That Keep Climbing

- Wages vs. Reality: Why Paychecks Don't Stretch

- Who Faces the Biggest Struggles?

- What Can You Do Right Now?

How Did Things Get This Bad?

It’s not just one thing that’s pushed the UK into a living crisis. Honestly, it’s been a mix of bad breaks, bad planning, and stuff way out of our control. Let’s lay it out plainly so you can see what’s going on.

First up, Brexit threw a spanner in the works. It made imports pricier, from tomatoes to tech gadgets. That means stores pay more, and, surprise, so do you. The pandemic didn’t help either. It messed up supply chains—so stuff was slower or simply missing from shelves. Less supply, more demand, higher prices. Simple as that.

Then came Russia’s invasion of Ukraine. Gas and oil got expensive, which hit energy bills hard. If you felt the pain last winter, you're not alone. Add to that a long stretch of wage growth lagging behind inflation. People saw prices go up, but pay packets just stood still.

It’s not just feelings, either. Here are some numbers to show how things have changed since 2020:

| Year | Food Price Increase (%) | Average Rent Rise (%) | Energy Bill (Annual Avg, £) | Wage Growth (%) |

|---|---|---|---|---|

| 2020 | 1.3 | 1.1 | 1,100 | 2.9 |

| 2022 | 13.9 | 3.8 | 2,500 | 5.5 |

| 2024 | 6.8 | 9.2 | 2,000 | 6.0 |

See that? Food prices jumped by double digits in 2022, energy bills more than doubled, and rent's only moving up. Wages crept up too, but not enough to match these jumps.

Banks also put interest rates up to try to get inflation under control. That’s great for savings, brutal for mortgages or debt. Suddenly, anyone trying to buy a home or pay off a loan was forking out even more each month.

So why is the UK in a mess? It’s all connected: Brexit, the global pandemic, war overseas, weak wage growth, and high interest rates. The result? Everyday costs going up way faster than what most folks bring home.

Everyday Costs That Keep Climbing

If you feel like your weekly shop, rent, and bills are all going up at once, you're not losing it. Everyday expenses in the UK have shot up since 2022—and there's proof.

Let's start with food. In 2024, grocery prices in the UK jumped about 25% compared to two years earlier, according to the Office for National Statistics. Simple basics like milk and bread cost so much more, you really notice it in your basket. And takeaways? They're pricier too, so even the occasional treat bites harder.

Now, rent. The average London rent just topped £2,200 a month. Nationally, the average hit £1,276 by spring 2025, up nearly 10% from last year. That's wild, especially when wages haven't kept pace. Even if you're not renting, mortgage interest payments have nearly doubled for many since rates spiked in 2023.

Then there's energy. In 2023 and early 2024, the UK energy price cap soared, at one point adding more than £1,000 to the average annual bill. Prices eased a bit in spring 2025, but most households still pay double what they did before the crisis.

| Item | 2023 Average Price | 2025 Average Price |

|---|---|---|

| 1L Milk | £1.05 | £1.32 |

| Electricity/Gas (annual) | £2,500 | £2,000 |

| London Monthly Rent | £2,000 | £2,200 |

Transport isn't giving anyone a break either. Train fares rose over 5% this year. Bus and Tube users in London saw Oyster and contactless fares creep up too. Add in increased petrol costs—nearly £1.60 per litre again in early 2025—and it feels like you're forking out more just to get around.

Here's what you can actually do to shave down some of these never-ending costs:

- Check if you’re eligible for council tax support or rent rebates. A ton of people qualify but don't claim.

- Shop basics and supermarket own brands—they really do save a few pounds over a month.

- Set up direct debits on your energy bills—suppliers usually give a small discount.

- Use Trainline or split ticketing apps; you’d be shocked how much cheaper long train journeys can be.

- When grocery shopping, look for yellow-label discounts close to closing time—big savings on good food.

The pain isn’t imaginary: the UK living crisis is real, and it’s in those everyday expenses you can’t dodge. Every pound saved counts, even when things feel overwhelmingly pricey.

Wages vs. Reality: Why Paychecks Don't Stretch

If you wonder why your paycheck disappears almost as soon as it lands in your account, you're not imagining things. In the UK, average wages just haven't managed to keep up with how fast prices are rising—so each month feels like you’re getting paid less, even if the number on your contract hasn’t changed.

Let’s talk real numbers: official inflation in the UK peaked at over 11% in late 2022—the highest it’s been since the early 80s. Average annual pay increases? They’ve hovered closer to 6% at their best in 2023 and early 2024. That gap means most people are technically earning less in real terms, even if their pay packet is a little bigger. Here’s how it stacks up:

| Year | Average UK Pay Increase (%) | UK Inflation Rate (%) |

|---|---|---|

| 2022 | 4.2 | 11.1 |

| 2023 | 6.0 | 7.9 |

| 2024 (early) | 5.6 | 4.0 |

So, unless you bagged a huge promotion, your money counts for less. That's why the UK living crisis feels so tough—not just for people on lower wages, but for plenty of folks who always thought they’d be fine.

It’s also about where you live and what you do for work. Public sector staff—nurses, teachers, council workers—felt the pinch harder, with wage rises often lagging behind private sector jobs. Some jobs even saw real-terms pay cuts once inflation did its damage.

This squeeze pushes people to:

- Take on second jobs or extra shifts, even when it strains their health and free time

- Cut out little luxuries (and eventually, essentials)

- Dip into savings—if they have any left—or rely on credit cards, building up debt

What can you do when your paycheck doesn't stretch? A few options help soften the blow, even if you can't wave a magic wand:

- Make a budget—boring, but knowing exactly where your money goes is half the battle

- Look for work perks or side hustles that make sense for your skills

- Check you’re getting any benefits, tax breaks, or grants you're eligible for—loads of people miss out just because they don't check

- If you’re struggling, talk to your landlord, bank, or energy supplier sooner, not later; fighting things alone makes it worse

Paychecks should cover the basics and give a bit of breathing room. Right now in Britain, too many just don’t stretch far enough—and that's the heart of the problem.

Who Faces the Biggest Struggles?

Not everyone feels the UK living crisis the same way. Some people really take the brunt—think renters, single parents, pensioners, people with disabilities, and low-paid workers. If you rent in London or any major city, you've seen prices shoot up over 10% in the last year alone. And single-parent families right now are twice as likely to skip meals as those in couples, according to a recent Joseph Rowntree Foundation report.

Food banks are handing out more parcels than ever, especially to working families. Child poverty rates have climbed to around 30%—that’s almost 1 in 3 kids trying to get by when basics like lunch and warm clothes are no longer guaranteed. If you’re on Universal Credit, things haven’t kept up either; benefits haven’t matched price jumps, so plenty are making tough choices at the end of the month.

- Pensioners on fixed incomes feel the pinch every time bills rise. Heating or eating? That’s a real question for a lot of older folks.

- Care workers, cleaners, and delivery drivers—jobs we all rely on—get squeezed harder since their pay isn’t keeping up with rent and food.

- People with disabilities face extra costs for travel, equipment, or special diets, and extra financial support often falls short.

| Group | Struggle | Recent Data |

|---|---|---|

| Private Renters | Rising rents, eviction risk | Average monthly rent rose by 9.2% (ONS, 2024) |

| Single Parents | Skipping meals, childcare costs | 2x more likely to miss meals (JRF, 2024) |

| Universal Credit Claimants | Benefits lag behind costs | Outgoings up 16%, benefits up 6% (IFS, 2024) |

| Pensioners | Heating and food price hikes | Fuel poverty affects 2+ million (Age UK, 2024) |

These aren’t just numbers—they show exactly who is feeling the real hit of the UK living crisis. Everyone’s stretched, but if you fit one of these groups, the struggle isn’t just tough, it’s often constant. If you’re in one of these spots, charities and local councils sometimes offer grants or short-term help, so don’t be shy about asking what’s available in your area.

What Can You Do Right Now?

It feels impossible sometimes, but there's actually a lot you can do to fight back against the UK living crisis. No, you can’t control inflation or suddenly make rents plummet, but even small shifts can help stretch your budget further.

If you want a clearer picture of where your money goes, track your outgoings for a couple of weeks. Plenty of apps now link to UK bank accounts—they’ll show you if takeaways, subscriptions, or random extras are draining your cash. Knowing where you stand is the first step.

- Check benefits and support: The government keeps adding new energy bill help and cost-of-living payments. In 2025, households on Universal Credit can get up to £300 extra in direct cash support. Don’t forget council tax rebates or discretionary housing payments from your local council.

- Switch and save on bills: Price comparison sites are your friend here. You might be able to knock £20-30 a month off mobile, broadband, or energy just by switching. Don't be shy about calling your provider and asking for a cheaper deal—they know other companies are hunting for your custom.

- Team up: If you rent, get your flatmates in on shared shopping, meal prep, or even group heating use. Supermarkets like Lidl, Aldi, and Iceland often beat the big names on basics. Consider food-sharing apps or local community fridges, especially for fresh stuff nearing its date.

- Travel cheap: Railcards save a third on train tickets for anyone under 30, carers, or people with disabilities. In London, if you use buses a lot, grab a weekly or monthly travel pass—it saves more than paying by journey.

Here's a quick look at where people are feeling the pinch in 2025:

| Category | Average Monthly Spend (2025) | Percent Change from 2023 |

|---|---|---|

| Rent (London, 1-bed flat) | £1,920 | +14% |

| Energy Bills (avg. household) | £180 | +10% |

| Groceries (single adult) | £275 | +9% |

| Public Transport (London Zones 1-3) | £159 | +5% |

If you're struggling to pay rent or bills, don’t wait until you’re in the red. Talk to your landlord, utility company, or local Citizens Advice. They’ll know about grants or payment plans most people never hear about until it’s too late.

And don’t underestimate the power of sharing info. Online groups, like local Facebook or WhatsApp communities, often swap tips about pop-up food banks, free kids' events, or new mutual aid funds. Sometimes help comes from the people living right next door.